Ali Rizvi

Article Billings, Bookings and Backlog: What’s the Difference?

In the life of a SaaS accountant, preparing a revenue report can get complex… quickly.

Every SaaS company has three distinct phases in its revenue lifecycle: billings, bookings and backlog. They are closely related, but it is important for SaaS founders to understand the difference.

To illustrate, let’s use the fictitious example of NewNew Software, a SaaS text messaging solution that has recently launched.

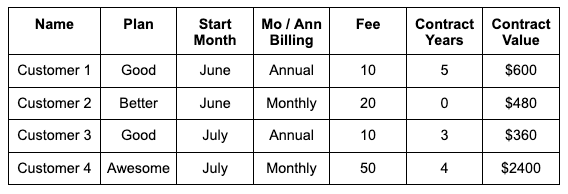

Like many SaaS providers, NewNew has three subscription plans for customers: Good (priced at $10/mo), Better ($20/mo) and Awesome ($50/mo). Any plan is auto-renewed 15 days before the end of the subscription term, unless the customer cancels.

NewNew is off to a great start and already has 4 paying customers signed up for subscriptions.

Here’s how NewNew’s customer contracts looked at the end of the company’s first two months of business (in this example, June and July):

We can use the information above to start calculating backlog, bookings and billings right away.

Backlog

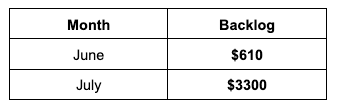

If NewNew’s leadership team wants to understand the company’s backlog, accounting calculates the total value of any and all outstanding orders not yet fulfilled by NewNew.

Regardless of when the payments for these orders will be received, they will be delivered on every month the contracts are active. Make sure to track start/end dates correctly and note when contracts will be rebilled to make sure they go out on time.

In the case of Customer 1, they’ve completed 2 months of an annual subscription, leaving 10 months and 4 years still to be delivered. Customer 3 has just completed one month of their annual subscription, leaving 11 months and 2 years to be delivered.

Customer 2, on the other hand, has completed 2 months of a monthly subscription, so (if desired) they can cancel in month 3 and be finished.

Customer 4 is paying by the month, but has a 4 year contract, so they have 11 months and 3 years remaining.

As you can see, this gets complicated to track as the number of contracts increases. Many companies opt for revenue recognition automation software when they pass 20 customer or more.

Using the information above, we can calculate the monthly backlog for NewNew.

Bookings

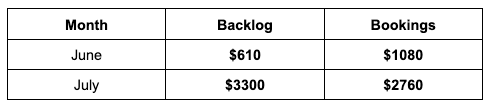

Bookings represent NewNew’s total contract value at a certain point in time. By looking at bookings, NewNew management can examine their sales momentum out in the field and forecast potential future revenue.

A booking is essentially a promise: the buyer will send future revenue over the span of a contract, in return for products and/or services. Bookings take into account what has been booked or contracted for over a certain period.

Let’s take a look at NewNew’s bookings report.

In June, NewNew signed contracts with two new customers: Customer 1 and Customer 2. To calculate bookings for June, accounting would add the total value of those contracts together.

For July, there would be a different bookings calculation. Two clients once again, but this time they are larger deals, indicating an acceleration in sales momentum.

Billings

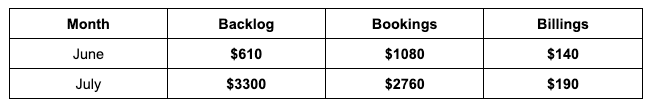

While bookings and backlog are important indicators for future cash flows, billings are especially important as they represent actual cash flow each month.

Without cash flowing, a business cannot operate, regardless of what cash is promised in the future. This is why billings is such an important metric for SaaS founders.

Billings are based on when the customer receives the invoice and when it is due. Does the customer pay in advance, or at the end of each term? Billings could be once per month, once per year, once per 6 months, or any other frequency that NewNew decides works best for customers.

In this case, NewNew’s current policy is to charge at the beginning of each month, 15-day net, so they receive each payment in the same month it is billed.

Customers 1 and 3 pay monthly, so their monthly subscription fee appears every month in billings.

Customers 2 and 4, however, pay annually. That means their billings will happen once per year, all at once, and they will appear only once in that month.

Looking at Sales Results via Billings, Bookings and Backlog

The above is a good example of why accounting has to look closely at all of these metrics, or they can end up giving leadership the wrong impression of the company’s sales results.

In the case of NewNew, the sales team should be commended for these trends:

- Backlog is rising month over month

- Bookings are rising month over month

- Billings are rising month over month

However, the rising trend in billings shown may be misleading to leadership. They could lead to over aggressive spending and a cash crunch.

Here’s why. If the sales team fails to sign another annual contract in August, monthly billings could fall by 50%, leaving the company cash starved when it needs to be delivering on its contracts for the next year.

As a SaaS accountant or controller, keeping a close eye on billings, bookings and backlog is a powerful tool to make sure your company is prepared for the future.

Computing SaaS Metrics like Bookings, Billings and Backlog

For many years, SaaS accountants have been using Excel or Google Sheets to manually track revenue forecasts and metrics.

Luckily, powerful financial operations automation has arrived to sync with general ledgers like Quickbooks and sales platforms like Salesforce to make the process easy. In fact, using economical finops platforms like TrueRev can help you calculate deferred revenue and see future cash flows in real time with ease.

Want to see a demo?

we offer a 14-day free trial.